Reach People In-Market for Parts & Service

MontAd Media uses Audience ID to identify people ready to buy replacement parts and service. We monitor trade professionals in many light duty and commercial parts categories. We also track consumers in-market for auto parts and service.

Connect with them using affordable online ads aligned to the parts and services they need.

July 2023

Light Duty Audiences

| Diagnostic Technicians | 143,668 |

| European Specialists | 23,194 |

| Engine Builders | 13,044 |

| Repair Pros Researching: | |

| – EPAS Issues | 7,162 |

| – Rotating Electric | 120,534 |

| – TPMS Relearn | 20,942 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 26,054 |

| Category 6 & Up Wheel End | 2,021 |

| Medium Duty Diesel Injectors | 29,556 |

| Last Mile Vehicle Technicians | 5,743 |

| Fleet Managers Researching ELD | 6,103 |

| Freightliner Air Brakes | 1,557 |

Consumer Audiences

| Brakes | 3,290,628 |

| Hubs & Bearings | 443,416 |

| Shocks & Struts | 1,282,085 |

| Fuel Pumps | 1,048,628 |

| Serpentine Belts | 437,883 |

| Check Engine Light | 860,542 |

| Wiper Blades | 766,614 |

| Chassis (DIFM) | 175,722 |

| Car Detailing | 1,292,400 |

| Performance Brakes | 49,157 |

| Performance Shocks & Struts | 22,217 |

| Tire Replacement | 2,821,322 |

| Battery Replacement | 1,542,779 |

June 2023

Light Duty Audiences

| Diagnostic Technicians | 143,668 |

| European Specialists | 23,194 |

| Engine Builders | 13,044 |

| Repair Pros Researching: | |

| – EPAS Issues | 7,162 |

| – Rotating Electric | 120,534 |

| – TPMS Relearn | 20,942 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 26,054 |

| Category 6 & Up Wheel End | 2,021 |

| Medium Duty Diesel Injectors | 29,556 |

| Last Mile Vehicle Technicians | 5,743 |

| Fleet Managers Researching ELD | 6,103 |

| Freightliner Air Brakes | 1,557 |

Consumer Audiences

| Brakes | 3,226,935 |

| Hubs & Bearings | 475,004 |

| Shocks & Struts | 1,282,085 |

| Fuel Pumps | 1,282,085 |

| Serpentine Belts | 443,459 |

| Check Engine Light | 782,173 |

| Wiper Blades | 345,115 |

| Chassis (DIFM) | 189,188 |

| Car Detailing | 1,316,237 |

| Performance Brakes | 40,536 |

| Performance Shocks & Struts | 30,220 |

| Tire Replacement | 2,980,892 |

| Battery Replacement | 1,407,806 |

May 2023

Light Duty Audiences

| Diagnostic Technicians | 136,029 |

| European Specialists | 23,194 |

| Engine Builders | 13,456 |

| Repair Pros Researching: | |

| – EPAS Issues | 7,162 |

| – Rotating Electric | 120,534 |

| – TPMS Relearn | 20,942 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 22,562 |

| Category 6 & Up Wheel End | 2,197 |

| Medium Duty Diesel Injectors | 26,251 |

| Last Mile Vehicle Technicians | 6,121 |

| Fleet Managers Researching ELD | 7,248 |

| Freightliner Air Brakes | 1,212 |

Consumer Audiences

| Brakes | 3,208,840 |

| Hubs & Bearings | 595,743 |

| Shocks & Struts | 1,115,522 |

| Fuel Pumps | 1,068,571 |

| Serpentine Belts | 445,560 |

| Check Engine Light | 770,209 |

| Wiper Blades | 307,712 |

| Chassis (DIFM) | 189,104 |

| Car Detailing | 1,529,179 |

| Performance Brakes | 44,057 |

| Performance Shocks & Struts | 34,259 |

| Tire Replacement | 3,323,954 |

| Battery Replacement | 1,347,188 |

April 2023

Light Duty Audiences

| Diagnostic Technicians | 137,879 |

| European Specialists | 24,481 |

| Engine Builders | 14,053 |

| Repair Pros Researching: | |

| – EPAS Issues | 8,132 |

| – Rotating Electric | 115,815 |

| – TPMS Relearn | 23,549 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 20,876 |

| Category 6 & Up Wheel End | 3,683 |

| Medium Duty Diesel Injectors | 22,672 |

| Last Mile Vehicle Technicians | 5,290 |

| Fleet Managers Researching ELD | 5,825 |

| Freightliner Air Brakes | 1,284 |

Consumer Audiences

| Brakes | 3,462,592 |

| Hubs & Bearings | 531,742 |

| Shocks & Struts | 1,237,521 |

| Fuel Pumps | 1,433,617 |

| Serpentine Belts | 458,259 |

| Check Engine Light | 753,557 |

| Wiper Blades | 591,191 |

| Chassis (DIFM) | 231,876 |

| Car Detailing | 1,409,553 |

| Performance Brakes | 39,432 |

| Performance Shocks & Struts | 36,886 |

| Tire Replacement | 3,087,196 |

| Battery Replacement | 1,515,720 |

March 2023

Light Duty Audiences

| Diagnostic Technicians | 182,139 |

| European Specialists | 29,376 |

| Engine Builders | 17,601 |

| Repair Pros Researching: | |

| – EPAS Issues | 8,792 |

| – Rotating Electric | 138,472 |

| – TPMS Relearn | 31,316 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 25,375 |

| Category 6 & Up Wheel End | 3,683 |

| Medium Duty Diesel Injectors | 28,863 |

| Last Mile Vehicle Technicians | 6,469 |

| Fleet Managers Researching ELD | 21,976 |

| Freightliner Air Brakes | 1,913 |

Consumer Audiences

| Brakes | 4,515,919 |

| Hubs & Bearings | 786,907 |

| Shocks & Struts | 1,419,617 |

| Fuel Pumps | 1,433,617 |

| Serpentine Belts | 517,809 |

| Check Engine Light | 999,418 |

| Wiper Blades | 811,653 |

| Chassis (DIFM) | 231,876 |

| Car Detailing | 2,178,581 |

| Performance Brakes | 48,179 |

| Performance Shocks & Struts | 35,265 |

| Tire Replacement | 3,720,430 |

| Battery Replacement | 1,736,351 |

February 2023 A shorter month and a drop in post-holiday fleet repairs led to less trade audience data than January, but last mile vehicle technician audiences were still up compared to November and December.

Light Duty Audiences

| Diagnostic Technicians | 156,080 |

| European Specialists | 24,038 |

| Engine Builders | 17,928 |

| Repair Pros Researching: | |

| – EPAS Issues | 7,321 |

| – Rotating Electric | 126,708 |

| – TPMS Relearn | 26,745 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 22,914 |

| Category 6 & Up Wheel End | 3,379 |

| Medium Duty Diesel Injectors | 25,931 |

| Last Mile Vehicle Technicians | 5,647 |

| Fleet Managers Researching ELD | 19,535 |

| Freightliner Air Brakes | 1,603 |

Consumer Audiences

| Brakes | 3,726,137 |

| Hubs & Bearings | 617,026 |

| Shocks & Struts | 1,295,116 |

| Fuel Pumps | 1,204,715 |

| Serpentine Belts | 467,898 |

| Check Engine Light | 903,112 |

| Wiper Blades | 685,329 |

| Chassis (DIFM) | 200,818 |

| Car Detailing | 2,499,494 |

| Performance Brakes | 42,465 |

| Performance Shocks & Struts | 34,316 |

| Tire Replacement | 3,844,772 |

| Battery Replacement | 1,501,482 |

January 2023 We saw a 20% increase in the last mile vehicle audience which makes sense since those vehicles spent so much time on the road during the holiday delivery season in December. There was also a significant increase in the fleet manager audience, also not unexpected.

Light Duty Audiences

| Diagnostic Technicians | 181,966 |

| European Specialists | 25,806 |

| Engine Builders | 18,601 |

| Repair Pros Researching: | |

| – EPAS Issues | 8,735 |

| – Rotating Electric | 145,515 |

| – TPMS Relearn | 30,787 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 25,777 |

| Category 6 & Up Wheel End | 3,702 |

| Medium Duty Diesel Injectors | 28,948 |

| Last Mile Vehicle Technicians | 6,412 |

| Fleet Managers Researching ELD | 20,024 |

| Freightliner Air Brakes | 1,832 |

Consumer Audiences

| Brakes | 4,934,831 |

| Hubs & Bearings | 625,738 |

| Shocks & Struts | 1,287,742 |

| Fuel Pumps | 1,291,051 |

| Serpentine Belts | 510,336 |

| Check Engine Light | 1,204,503 |

| Wiper Blades | 1,068,535 |

| Chassis (DIFM) | 215,682 |

| Car Detailing | 1,913,345 |

| Performance Brakes | 71,381 |

| Performance Shocks & Struts | 24,346 |

| Tire Replacement | 4,090,019 |

| Battery Replacement | 1,741,380 |

December 2022 We’ve tracked the last mile vehicle technician audience for 3 months now. The data is consistent with an expected continued increase in fleet managers researching electronic logging issues. Other trade audiences are similar to November. Consumer audience categories saw a few drops compared to November except for shocks which were up a bit. Wiper blades really jumped, likely due to the “cyclone bomb” weather that hit much of the country.

Light Duty Audiences

| Diagnostic Technicians | 158,498 |

| European Specialists | 24,666 |

| Engine Builders | 18,177 |

| Repair Pros Researching: | |

| – EPAS Issues | 7,431 |

| – Rotating Electric | 153,539 |

| – TPMS Relearn | 32,488 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 25,923 |

| Category 6 & Up Wheel End | 3,286 |

| Medium Duty Diesel Injectors | 28,318 |

| Last Mile Vehicle Technicians | 5,322 |

| Fleet Managers Researching ELD | 16,247 |

| Freightliner Air Brakes | 2,014 |

Consumer Audiences

| Brakes | 5,714,848 |

| Hubs & Bearings | 604,545 |

| Shocks & Struts | 1,315,559 |

| Fuel Pumps | 1,249,642 |

| Serpentine Belts | 477,337 |

| Check Engine Light | 1,549,633 |

| Wiper Blades | 837,633 |

| Chassis (DIFM) | 198,828 |

| Car Detailing | 2,060,349 |

| Performance Brakes | 41,461 |

| Performance Shocks & Struts | 44,246 |

| Tire Replacement | 3,531,092 |

| Battery Replacement | 1,713,788 |

November 2022 Our first two months of data for last mile vehicle technicians is consistent between November and October. This month, we saw a significant jump in fleet managers researching electronic logging device issues and added the category below. Consumer audiences saw a slightly downward trend as the holidays approach. That’s consistent with data from pre-Covid years.

Light Duty Audiences

| Diagnostic Technicians | 158,511 |

| European Specialists | 26,034 |

| Engine Builders | 21,692 |

| Repair Pros Researching: | |

| – EPAS Issues | 7,893 |

| – Rotating Electric | 151,738 |

| – TPMS Relearn | 36,692 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 27,995 |

| Category 6 & Up Wheel End | 2,719 |

| Medium Duty Diesel Injectors | 32,575 |

| Last Mile Vehicle Technicians | 5,220 |

| Fleet Managers Researching ELD | 12,288 |

| Freightliner Brake Replacement | 2,062 |

Consumer Audiences

| Brakes | 5,403,026 |

| Hubs & Bearings | 644,423 |

| Shocks & Struts | 1,162,559 |

| Fuel Pumps | 1,332,778 |

| Serpentine Belts | 486,250 |

| Check Engine Light | 1,382,118 |

| Wiper Blades | 412,218 |

| Chassis (DIFM) | 202,026 |

| Car Detailing | 2,346,819 |

| Performance Brakes | 40,620 |

| Performance Shocks & Struts | 21,545 |

| Tire Replacement | 3,998,790 |

| Battery Replacement | 2,085,044 |

October 2022 This month we added Last Mile Vehicle audiences and two very specific examples of focused application specific fleet audiences. Consumer data shows strong demand continuing in brakes categories while most other categories were slightly down from a strong September.

Light Duty Audiences

| Diagnostic Technicians | 176,537 |

| European Specialists | 29,514 |

| Engine Builders | 19,989 |

| Repair Pros Researching: | |

| – EPAS Issues | 8,624 |

| – Rotating Electric | 165,356 |

| – TPMS Relearn | 34,029 |

Commercial, Fleet & Heavy Duty

| Diesel Aftertreatment | 32,443 |

| Category 6 & Up Wheel End | 3,224 |

| Medium Duty Diesel Injectors | 30,531 |

| Last Mile Vehicle Technicians | 5,212 |

| Techs Servicing Collins Buses | 1,414 |

| Freightliner Brake Replacement | 2,192 |

Consumer Audiences

| Brakes | 6,969,932 |

| Hubs & Bearings | 658,788 |

| Shocks & Struts | 1,383,386 |

| Fuel Pumps | 1,468,129 |

| Serpentine Belts | 525,081 |

| Check Engine Light | 1,698,094 |

| Wiper Blades | 521,669 |

| Chassis (DIFM) | 232,196 |

| Car Detailing | 2,715,862 |

| Performance Brakes | 96,498 |

| Performance Shocks & Struts | 25,110 |

| Tire Replacement | 4,176,377 |

| Battery Replacement | 2,337,336 |

September 2022 The brakes category performed very well in September and tire replacement rose significantly. That apparently impacted the TPMS trade audience with numbers higher than they were in August.

Light Duty Audiences

| Diagnostic Technicians | 178,295 |

| European Specialists | 29,987 |

| Engine Builders | 18,609 |

| Repair Pros Researching: | |

| – EPAS Issues | 8,798 |

| – Rotating Electric | 179,959 |

| – TPMS Relearn | 31,891 |

Commercial, Fleet & Heavy Duty

| Sprinter & Promaster Parts | 19,995 |

| Cat. 6 & Up Diesel Aftertreatment | 8,002 |

| Medium Duty Diesel Injectors | 30,418 |

| Last Mile Vehicle Turbochargers | 9,381 |

| Fleet Managers & Parts Buyers | 37,971 |

| Freightliner Brake Replacement | 2,572 |

Consumer Audiences

| Brakes | 6,218,322 |

| Hubs & Bearings | 675,916 |

| Shocks & Struts | 1,290,330 |

| Fuel Pumps | 1,787,747 |

| Serpentine Belts | 579,065 |

| Check Engine Light | 1,466,129 |

| Wiper Blades | 973,653 |

| Chassis (DIFM) | 234,735 |

| Car Detailing | 2,743,458 |

| Performance Brakes | 81,074 |

| Performance Shocks & Struts | 35,535 |

| Tire Replacement | 3,419,541 |

| Battery Replacement | 2,319,541 |

August 2022 In all, August looked like a good month for the aftermarket and that bodes well for the fall season. There was strong growth in several categories with brake repair and replacement taking the lead. As a matter of fact, this audience was the biggest we’ve seen since April of 2019! Our trades audiences grew significantly in most categories as well.

Light Duty Audiences

| Diagnostic Technicians | 175,838 |

| European Specialists | 24,387 |

| Engine Builders | 15,860 |

| Repair Pros Researching: | |

| – EPAS Issues | 9,132 |

| – Rotating Electric | 183,893 |

| – TPMS Relearn | 29,568 |

Commercial, Fleet & Heavy Duty

| Sprinter & Promaster Parts | 17,259 |

| Cat. 6 & Up Diesel Aftertreatment | 8,394 |

| Medium Duty Diesel Injectors | 30,740 |

| Last Mile Vehicle Turbochargers | 9,467 |

| Fleet Managers & Parts Buyers | 38,832 |

| Freightliner Brake Replacement | 2,164 |

Consumer Audiences

| Brakes | 5,007,174 |

| Hubs & Bearings | 695,067 |

| Shocks & Struts | 1,192,851 |

| Fuel Pumps | 1,497,922 |

| Serpentine Belts | 588,269 |

| Check Engine Light | 1,188,148 |

| Wiper Blades | 821,486 |

| Chassis (DIFM) | 233,341 |

| Car Detailing | 2,388,785 |

| Performance Brakes | 73,036 |

| Performance Shocks & Struts | 27,271 |

| Tire Replacement | 3,282,831 |

| Battery Replacement | 2,157,339 |

July 2022 Last month there were significant increases in consumers researching brake replacement, wheel end, and performance brakes. Our brake replacement audience is the biggest we’ve seen this year. A general lift in Last Mile vehicle parts buyers and fleet managers audiences is also apparent.

Light Duty Audiences

| Diagnostic Technicians | 171,506 |

| European Specialists | 22,961 |

| Engine Builders | 15,857 |

| Repair Pros Researching: | |

| – EPAS Issues | 8,839 |

| – Rotating Electric | 178,856 |

| – TPMS Relearn | 26,624 |

Commercial, Fleet & Heavy Duty

| Sprinter & Promaster Parts | 16,486 |

| Cat. 6 & Up Diesel Aftertreatment | 7,531 |

| Medium Duty Diesel Injectors | 34,607 |

| Last Mile Vehicle Turbochargers | 8,081 |

| Fleet Managers & Parts Buyers | 33,902 |

| Freightliner Brake Replacement | 1,749 |

Consumer Audiences

| Brakes | 4,719,473 |

| Hubs & Bearings | 482,297 |

| Shocks & Struts | 1,082,135 |

| Fuel Pumps | 1,449,766 |

| Serpentine Belts | 607,180 |

| Check Engine Light | 1,121,004 |

| Wiper Blades | 817,604 |

| Chassis (DIFM) | 225,752 |

| Car Detailing | 1,937,067 |

| Performance Brakes | 73,577 |

| Performance Shocks & Struts | 24,680 |

| Tire Replacement | 3,423,582 |

| Battery Replacement | 1,909,203 |

June 2022 Trade audiences were relatively flat in June with some showing slight decreases. We saw a big jump in the car detailing audiences which is expected this time of year. There was also significant increases in the tire replacement and check engine light audiences as consumers prepare for summer vacation road travel.

Light Duty Audiences

| Diagnostic Technicians | 165,718 |

| European Specialists | 21,663 |

| Engine Builders | 10,548 |

| Repair Pros Researching: | |

| – EPAS Issues | 9,342 |

| – Rotating Electric | 169,742 |

| – TPMS Relearn | 24,052 |

Commercial, Fleet & Heavy Duty

| Sprinter & Promaster Parts | 12,333 |

| Cat. 6 & Up Diesel Aftertreatment | 7,807 |

| Medium Duty Diesel Injectors | 27,594 |

| Last Mile Vehicle Turbochargers | 8,282 |

| Fleet Managers & Parts Buyers | 22,783 |

| Freightliner Brake Replacement | 1,668 |

Consumer Audiences

| Brakes | 3,787,680 |

| Hubs & Bearings | 580,254 |

| Shocks & Struts | 1,057,559 |

| Fuel Pumps | 1,410,118 |

| Serpentine Belts | 548,975 |

| Check Engine Light | 1,029,581 |

| Wiper Blades | 665,767 |

| Chassis (DIFM) | 209,159 |

| Car Detailing | 1,660,706 |

| Performance Brakes | 48,386 |

| Performance Shocks & Struts | 26,840 |

| Tire Replacement | 3,749,025 |

| Battery Replacement | 1,639,587 |

May 2022 Both our trade and consumer audiences are trending slightly lower than we’ve seen in recent months. This may be due to the general impact gas prices and inflation are having on the aftermarket. With Summer driving season starting, it will be interesting to review the June and July numbers.

Light Duty Audiences

| Diagnostic Technicians | 183,016 |

| European Specialists | 25,394 |

| Engine Builders | 10,548 |

| Repair Pros Researching: | |

| – EPAS Issues | 10,548 |

| – Rotating Electric | 166,109 |

| – TPMS Relearn | 26,323 |

Commercial, Fleet & Heavy Duty

| Sprinter & Promaster Parts | 10,862 |

| Cat. 6 & Up Diesel Aftertreatment | 8,265 |

| Medium Duty Diesel Injectors | 43,853 |

| Last Mile Vehicle Turbochargers | 8,467 |

| Fleet Managers & Parts Buyers | 14,156 |

| Freightliner Brake Replacement | 1,940 |

Consumer Audiences

| Brakes | 3,785,657 |

| Hubs & Bearings | 603,478 |

| Shocks & Struts | 1,029,810 |

| Fuel Pumps | 1,509,542 |

| Serpentine Belts | 665,056 |

| Check Engine Light | 887,445 |

| Wiper Blades | 598,860 |

| Chassis (DIFM) | 286,920 |

| Car Detailing | 1,385,590 |

| Performance Brakes | 49,640 |

| Performance Shocks & Struts | 27,764 |

| Tire Replacement | 3,104,417 |

| Battery Replacement | 1,614,898 |

April 2022 Considering one less day of data, both light duty and heavy duty/fleet trade audiences are consistent with March trends. Consumer audiences are consistent as well except for the expected increase in the performance categories and a significant increase in the detailing audience.

Light Duty Audiences

| Diagnostic Technicians | 198,759 |

| European Specialists | 25,958 |

| Engine Builders | 16,552 |

| Repair Pros Researching: | |

| – EPAS Issues | 14,814 |

| – Rotating Electric | 179,707 |

| – TPMS Relearn | 26,524 |

Commercial, Fleet & Heavy Duty

| Sprinter & Promaster Parts | 12,059 |

| Cat. 6 & Up Diesel Aftertreatment | 9,269 |

| Medium Duty Diesel Injectors | 36,753 |

| Last Mile Vehicle Turbochargers | 9,450 |

| Fleet Managers & Parts Buyers | 33,083 |

| Freightliner Brake Replacement | 1,996 |

Consumer Audiences

| Brakes | 4,201,364 |

| Hubs & Bearings | 698,848 |

| Shocks & Struts | 1,126,508 |

| Fuel Pumps | 1,570,799 |

| Serpentine Belts | 590,599 |

| Check Engine Light | 984,985 |

| Wiper Blades | 641,525 |

| Chassis (DIFM) | 289,990 |

| Car Detailing | 1,711,054 |

| Performance Brakes | 55,413 |

| Performance Shocks & Struts | 30,530 |

| Tire Replacement | 3,086,147 |

| Battery Replacement | 1,900,436 |

March 2022 Our exclusive Audience ID platform allows us to monitor dozens of light duty, commercial, fleet and heavy duty trade audiences. We can find and deliver your messages efficiently to ANY trade audience. Below are some examples from March.

Light Duty Audiences

| Diagnostic Technicians | 204,786 |

| European Specialists | 24,994 |

| Engine Builders | 17,385 |

| Repair Pros Researching: | |

| – EPAS Issues | 15,510 |

| – Rotating Electric | 181,422 |

| – TPMS Relearn | 28,207 |

Commercial, Fleet & Heavy Duty

| Sprinter & Promaster Parts | 13,107 |

| Cat. 6 & Up Diesel Aftertreatment | 9,850 |

| Medium Duty Diesel Injectors | 38,989 |

| Last Mile Vehicle Turbochargers | 9,758 |

| Fleet Managers & Parts Buyers | 31,896 |

| Freightliner Brake Replacement | 2,064 |

Consumer Audiences

| Brakes | 4,016,790 |

| Hubs & Bearings | 734,371 |

| Shocks & Struts | 1,227,218 |

| Fuel Pumps | 1,637,733 |

| Serpentine Belts | 594,195 |

| Check Engine Light | 1,200,018 |

| Wiper Blades | 700,307 |

| Chassis (DIFM) | 288,504 |

| Car Detailing | 1,283,688 |

| Performance Brakes | 53,790 |

| Performance Shocks & Struts | 29,574 |

| Tire Replacement | 3,218,788 |

| Battery Replacement | 1,973,930 |

February 2022 Across the board numbers were down a bit from January. However, even with a shorter month there was a continued increase in consumers researching CHECK ENGINE LIGHT. February marks the beginning of pothole season, so we see an expected seasonal jump in the shocks, suspension and chassis categories.

Consumer Audiences

| Brakes | 3,645,740 |

| Hubs & Bearings | 598,980 |

| Shocks & Struts | 1,234,621 |

| Fuel Pumps | 1,469,934 |

| Serpentine Belts | 564,739 |

| Check Engine Light | 1,059,903 |

| Wiper Blades | 903,181 |

| Chassis (DIFM) | 259,753 |

| Car Detailing | 550,873 |

| Performance Brakes | 46,159 |

| Perf. Shocks & Struts | 34,551 |

| Tire Replacement | 3,179,023 |

| Battery Replacement | 1,662,041 |

Niche Trade Audiences

| Heavy Duty Techs | 24,416 |

| Fleet Managers | 30,381 |

| Light Duty Diesel Techs | 39,481 |

| Diagnostic Specialists | 179,785 |

| Techs Researching EPAS | 14,207 |

January 2022 All repair and replacement categories increased significantly from December 2021 numbers. That is consistent with past years. The 14% increase in consumers researching CHECK ENGINE LIGHT is one example. In We also saw a big jump in our trade audience compared to last month.

Consumer Audiences

| Brakes | 4,153,130 |

| Hubs & Bearings | 635,115 |

| Shocks & Struts | 1,217,332 |

| Fuel Pumps | 1,467,111 |

| Serpentine Belts | 579,563 |

| Check Engine Light | 946,697 |

| Wiper Blades | 839,168 |

| Chassis (DIFM) | 254,502 |

| Car Detailing | 716,201 |

| Performance Brakes | 70,952 |

| Perf. Shocks & Struts | 33,525 |

| Tire Replacement | 3,780,047 |

| Battery Replacement | 1,830,668 |

Niche Trade Audiences

| Heavy Duty Techs | 30,444 |

| Fleet Managers | 29,117 |

| Light Duty Diesel Techs | 38,517 |

| Diagnostic Specialists | 181,065 |

| Techs Researching EPAS | 14,380 |

December 2021 The research on consumers researching parts and service was relatively flat compared to last month. The Battery and Wiper Blade categories went up, however, and the Detailing category went down. The repair professional data shows a significant increase in the audience of Fleet Managers since this audience includes the managers of last mile fleets.

Consumer Audiences

| Brakes | 3,685,014 |

| Hubs & Bearings | 569,097 |

| Shocks & Struts | 1,067,380 |

| Fuel Pumps | 1,329,518 |

| Serpentine Belts | 513,550 |

| Check Engine Light | 833,190 |

| Wiper Blades | 870,654 |

| Chassis (DIFM) | 240,943 |

| Car Detailing | 847,710 |

| Performance Brakes | 43,688 |

| Perf. Shocks & Struts | 29,162 |

| Tire Replacement | 3,420,693 |

| Battery Replacement | 1,819,904 |

Niche Trade Audiences

| Heavy Duty Techs | 21,691 |

| Fleet Managers | 26,872 |

| Light Duty Diesel Techs | 33,696 |

| Diagnostic Specialists | 165,714 |

| Techs Researching EPAS | 13,076 |

November 2021 We continue to see the Fuel Pump, Hubs, Belts, and Chassis categories outperform. This is consistent with a continually aging VIO average. We’re interested in any feedback from readers regarding these trends.

Consumer Audiences

| Brakes | 3,495,217 |

| Hubs & Bearings | 659,420 |

| Shocks & Struts | 1,075,130 |

| Fuel Pumps | 1,340,639 |

| Serpentine Belts | 510,568 |

| Check Engine Light | 879,981 |

| Wiper Blades | 625,944 |

| Chassis (DIFM) | 239,912 |

| Car Detailing | 1,179,636 |

| Performance Brakes | 46,317 |

| Perf. Shocks & Struts | 30,132 |

| Tire Replacement | 3,629,996 |

| Battery Replacement | 1,557,428 |

Niche Trade Audiences

| Heavy Duty Techs | 18,425 |

| Fleet Managers | 19,651 |

| Light Duty Diesel Techs | 36,052 |

| Diagnostic Specialists | 165,110 |

| Techs Researching EPAS | 12,359 |

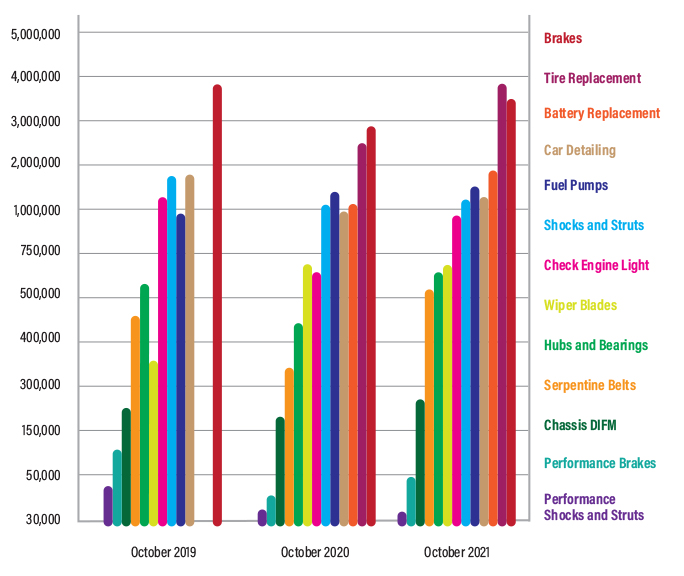

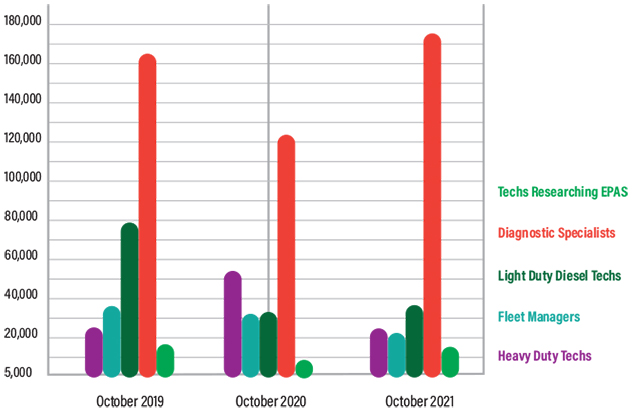

October 2021 Some parts categories continue to outperform: Fuel delivery, wheel end, chassis, and belts & tensioners. Our audience of tech researching complex diagnostic issues is also up over 30% from last year, and 6% above Oct 2019 numbers. It will be interesting to review repair order data to see if average ROs increased as the data suggests it might.

Consumer Audiences

| Brakes | 3,457,864 |

| Hubs & Bearings | 631,726 |

| Shocks & Struts | 1,115,760 |

| Fuel Pumps | 1,393,015 |

| Serpentine Belts | 510,080 |

| Check Engine Light | 921,368 |

| Wiper Blades | 652,648 |

| Chassis (DIFM) | 249,028 |

| Car Detailing | 1,179,636 |

| Performance Brakes | 47,242 |

| Perf. Shocks & Struts | 31,107 |

| Tire Replacement | 3,837,627 |

| Battery Replacement | 1,849,282 |

Niche Trade Audiences

| Heavy Duty Techs | 22,396 |

| Fleet Managers | 21,557 |

| Light Duty Diesel Techs | 36,052 |

| Diagnostic Specialists | 175,152 |

| Techs Researching EPAS | 12,442 |

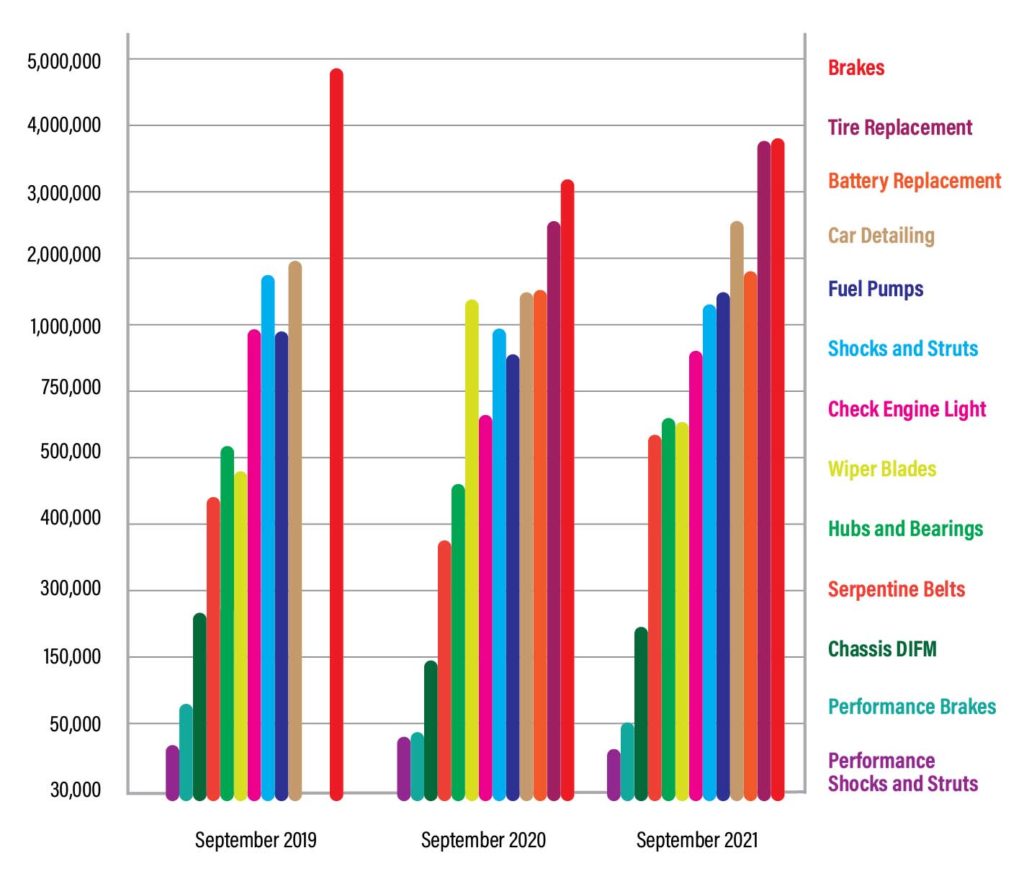

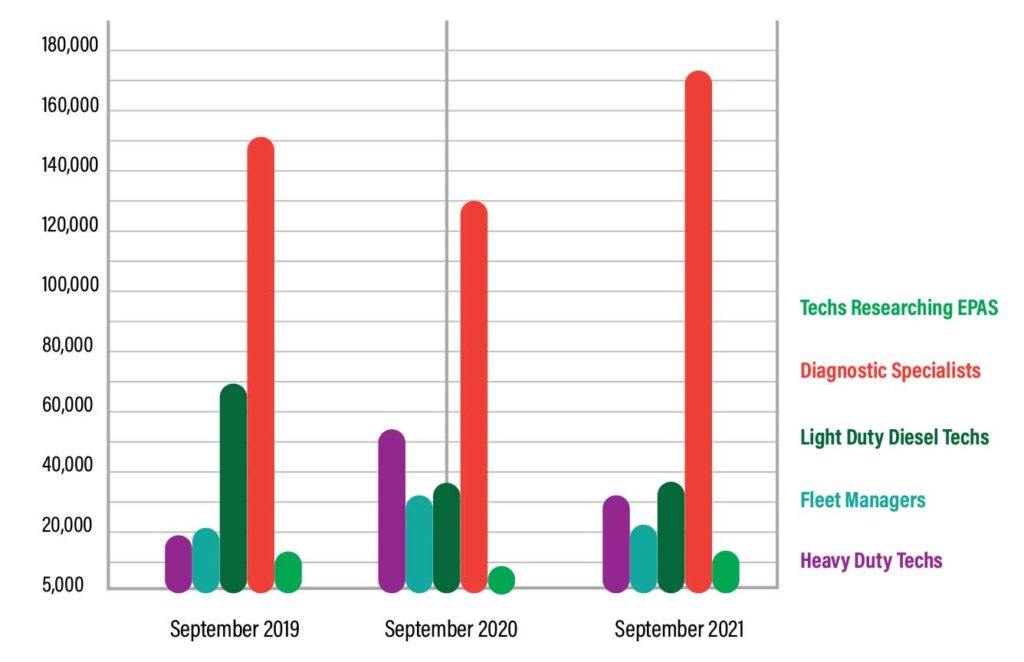

September 2021 Most categories continued to lag 2019 data but exceeded the 2020 numbers. As they did last month, the categories that continue to see significant increases in online research by consumers are Fuel Pumps, Hubs and Bearings, Serpentine Belts and Chassis DIFM. We tracked 10 chassis specific audiences and saw significant increases last month in the technician and DIY audiences researching ball joint, tie rod and steering linkage issues. Any feedback from readers regarding this trend would be appreciated.

Consumer Audiences

| Brakes | 3,754,052 |

| Hubs & Bearings | 603,609 |

| Shocks & Struts | 1,183,751 |

| Fuel Pumps | 1,377,045 |

| Serpentine Belts | 531,786 |

| Check Engine Light | 876,264 |

| Wiper Blades | 590,641 |

| Chassis (DIFM) | 255,331 |

| Car Detailing | 1,215,083 |

| Performance Brakes | 49,724 |

| Perf. Shocks & Struts | 34,419 |

| Tire Replacement | 3,770,881 |

| Battery Replacement | 1,733,623 |

Niche Trade Audiences

| Heavy Duty Techs | 31,685 |

| Fleet Managers | 22,144 |

| Light Duty Diesel Techs | 37,192 |

| Diagnostic Specialists | 174,310 |

| Techs Researching EPAS | 12,867 |

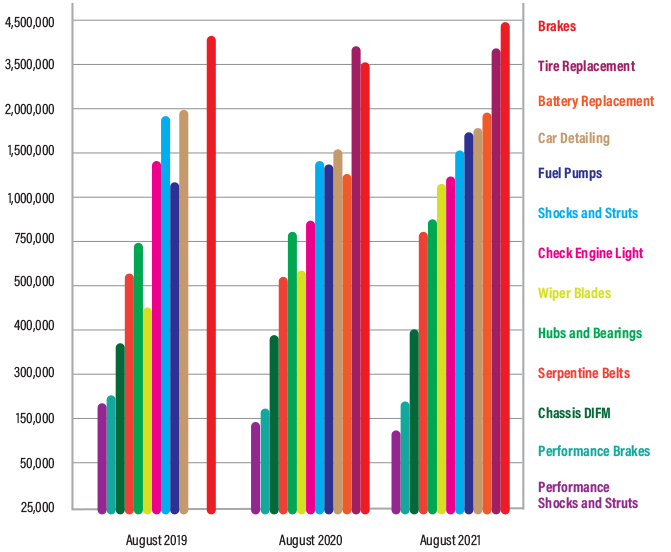

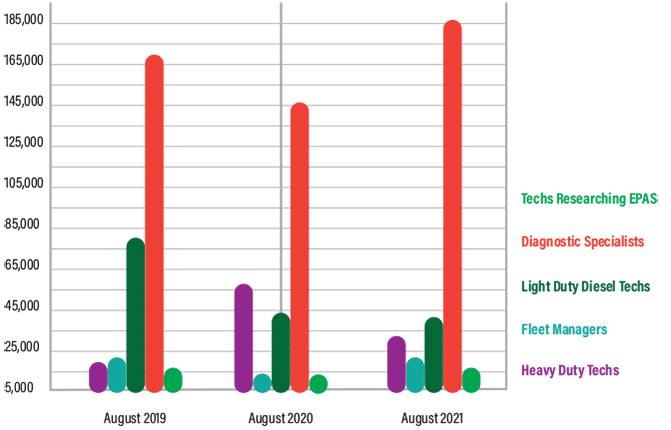

August 2021 When comparing August 2019, 2020 and 2021, we found that for most categories, online research this year met or exceeded that in August 2019. There were significant increases in the fuel pump, hubs and bearings and chassis DIFM categories. Combined with an increased diagnostic specialist audience, this may indicate higher ROIs for shops in August.

Consumer Audiences

| Brakes | 2,881,708 |

| Hubs & Bearings | 659,522 |

| Shocks & Struts | 1,252,020 |

| Fuel Pumps | 1,496,022 |

| Serpentine Belts | 581,189 |

| Check Engine Light | 972,279 |

| Wiper Blades | 832,131 |

| Chassis (DIFM) | 291,752 |

| Car Detailing | 1,520,261 |

| Performance Brakes | 59,319 |

| Perf. Shocks & Struts | 38,560 |

| Tire Replacement | 3,538,479 |

| Battery Replacement | 1,735,258 |

Niche Trade Audiences

| Heavy Duty Techs | 30,413 |

| Fleet Managers | 21,385 |

| Light Duty Diesel Techs | 39,016 |

| Diagnostic Specialists | 186,305 |

| Techs Researching EPAS | 15,153 |

October 2020 While Fuel Pump and Shocks & Struts numbers rose, we saw underwhelming numbers in many categories. Others stayed steady.

Consumer Audiences

| Brakes | 2,881,708 |

| Hubs & Bearings | 436,535 |

| Shocks & Struts | 1,047,306 |

| Fuel Pumps | 1,285,667 |

| Serpentine Belts | 330,175 |

| Check Engine Light | 632,785 |

| Wiper Blades | 664,958 |

| Chassis (DIFM) | 178,047 |

| Car Detailing | 924,196 |

| Performance Brakes | 37,343 |

| Perf. Shocks & Struts | 32,960 |

| Tire Replacement | 2,430,463 |

| Battery Replacement | 1,085,506 |

Niche Trade Audiences

| Heavy Duty Techs | 52,788 |

| Fleet Managers | 31,074 |

| Light Duty Diesel Techs | 31,340 |

| Diagnostic Specialists | 122,512 |

| Techs Researching EPAS | 7,824 |

September 2020 Although online research dropped for many categories, we saw a big lift in consumer wiper blade and fleet manager audiences. The impact of sales promotions and industry regulation changes seem to be why.

Consumer Audiences

| Brakes | 3,036,772 |

| Hubs & Bearings | 449,663 |

| Shocks & Struts | 989,012 |

| Fuel Pumps | 892,787 |

| Serpentine Belts | 371,582 |

| Check Engine Light | 630,330 |

| Wiper Blades | 1,184,559 |

| Chassis (DIFM) | 194,928 |

| Car Detailing | 1,276,809 |

| Performance Brakes | 44,763 |

| Perf. Shocks & Struts | 38,951 |

| Tire Replacement | 2,537,366 |

| Battery Replacement | 1,699,874 |

Niche Trade Audiences

| Heavy Duty Techs | 54,421 |

| Fleet Managers | 31,474 |

| Light Duty Diesel Techs | 35,446 |

| Diagnostic Specialists | 129,067 |

| Techs Researching EPAS | 7,779 |

August 2020 The data for consumers researching brake replacement and tire replacement was up 10% and 14% respectively. We also saw a big spike in heavy duty technicians researching repair issues online. In general, other categories showed less growth.

Consumer Audiences

| Brakes | 3,439,481 |

| Hubs & Bearings | 563,761 |

| Shocks & Struts | 1,187,561 |

| Fuel Pumps | 1,014,510 |

| Serpentine Belts | 404,027 |

| Check Engine Light | 684,535 |

| Wiper Blades | 415,170 |

| Chassis (DIFM) | 224,361 |

| Car Detailing | 1,268,361 |

| Performance Brakes | 55,058 |

| Perf. Shocks & Struts | 46,912 |

| Tire Replacement | 3,667,996 |

| Battery Replacement | 1,092,341 |

Niche Trade Audiences

| Heavy Duty Techs | 56,416 |

| Fleet Managers | 14,550 |

| Light Duty Diesel Techs | 42,711 |

| Diagnostic Specialists | 145,889 |

| Techs Researching EPAS | 8,270 |

JULY 2020 Automotive parts and service in-market data for most categories was flat compared to June, but the number of consumers researching tire replacement was up 13%. However, we saw significantly increased online activity in the heavy duty and fleet categories.

Consumer Audiences

| Brakes | 3,134,919 |

| Hubs & Bearings | 475,096 |

| Shocks & Struts | 1,309,355 |

| Fuel Pumps | 1,040,216 |

| Serpentine Belts | 426,629 |

| Check Engine Light | 649,447 |

| Wiper Blades | 237,833 |

| Chassis (DIFM) | 245,793 |

| Car Detailing | 1,442,676 |

| Performance Brakes | 54,685 |

| Perf. Shocks & Struts | 54,726 |

| Tire Replacement | 3,205,723 |

| Battery Replacement | 1,069,336 |

Niche Trade Audiences

| Heavy Duty Techs | 41,828 |

| Fleet Managers | 18,293 |

| Light Duty Diesel Techs | 49,729 |

| Diagnostic Specialists | 144,339 |

| Techs Researching EPAS | 8,224 |

JUNE 2020 With demand for several parts categories returning to June 2019 levels, and strong online research activity, especially by heavy duty technicians, we see opportunities for manufacturers of heavy duty parts.

Consumer Audiences

| Brakes | 3,302,523 |

| Hubs & Bearings | 446,521 |

| Shocks & Struts | 1,720,931 |

| Fuel Pumps | 1,031,010 |

| Serpentine Belts | 426,338 |

| Check Engine Light | 607,255 |

| Wiper Blades | 223,792 |

| Chassis (DIFM) | 221,796 |

| Car Detailing | 1,262,024 |

| Performance Brakes | 64,429 |

| Perf. Shocks & Struts | 80,850 |

| Tire Replacement | 2,822,121 |

| Battery Replacement | 1,009,087 |

Niche Trade Audiences

| Heavy Duty Techs | 32,384 |

| Fleet Managers | 16,846 |

| Light Duty Diesel Techs | 61,660 |

| Diagnostic Specialists | 142,598 |

| Techs Researching EPAS | 8,172 |

MAY 2020 Our data for May shows strong online activity for content specific to heavy duty and fleet audiences, and have even surpassed the numbers from May 2019.

Consumer Audiences

| Brakes | 3,121,636 |

| Hubs & Bearings | 471,461 |

| Shocks & Struts | 1,309,888 |

| Fuel Pumps | 979,718 |

| Serpentine Belts | 393,383 |

| Check Engine Light | 629,985 |

| Wiper Blades | 198,178 |

| Chassis (DIFM) | 233,393 |

| Car Detailing | 1,286,987 |

| Performance Brakes | 66,405 |

| Perf. Shocks & Struts | 50,862 |

| Tire Replacement | 2,982,459 |

| Battery Replacement | 987,551 |

Niche Trade Audiences

| Heavy Duty Techs | 30,451 |

| Fleet Managers | 15,594 |

| Light Duty Diesel Techs | 84,097 |

| Diagnostic Specialists | 130,714 |

| Techs Researching EPAS | 10,745 |

APRIL 2020 The Covid-19 crisis has continued to impact both consumer and trade audiences. But we did see a significant increase from March data. That is an encouraging sign for our industry!

Consumer Audiences

| Brakes | 2,757,628 |

| Hubs & Bearings | 406,071 |

| Shocks & Struts | 1,306,766 |

| Fuel Pumps | 906,454 |

| Serpentine Belts | 348,793 |

| Check Engine Light | 567,739 |

| Wiper Blades | 183,564 |

| Chassis (DIFM) | 208,816 |

| Car Detailing | 1,416,540 |

| Performance Brakes | 63,186 |

| Perf. Shocks & Struts | 49,262 |

| Tire Replacement | 2,196,523 |

| Battery Replacement | 816,277 |

Niche Trade Audiences

| Heavy Duty Techs | 13,016 |

| Fleet Managers | 12,342 |

| Light Duty Diesel Techs | 79,575 |

| Diagnostic Specialists | 116,832 |

| Techs Researching EPAS | 10,940 |

MARCH 2020 As expected, we saw a significant drop in both consumer and trade audience activity due to the Covid 19 pandemic. Heavy Duty Techs were the exception.

Consumer Audiences

| Brakes | 2,069,171 |

| Hubs & Bearings | 309,920 |

| Shocks & Struts | 850,877 |

| Fuel Pumps | 671,107 |

| Serpentine Belts | 261,140 |

| Check Engine Light | 501,265 |

| Wiper Blades | 153,495 |

| Chassis (DIFM) | 133,320 |

| Car Detailing | 842,223 |

| Performance Brakes | 53,676 |

| Perf. Shocks & Struts | 31,713 |

| Tire Replacement | 1,501,048 |

| Battery Replacement | 659,480 |

Niche Trade Audiences

| Heavy Duty Techs | 12,727 |

| Fleet Managers | 11,037 |

| Light Duty Diesel Techs | 52,762 |

| Diagnostic Specialists | 93,583 |

| Techs Researching EPAS | 7,831 |

FEBRUARY 2020 In almost all categories, the number of consumers researching auto parts & service was down from February 2019. A mild winter seems to have contributed to lower demand.

Consumer Audiences

| Brakes | 3,270,220 |

| Hubs & Bearings | 505,447 |

| Shocks & Struts | 1,353,296 |

| Fuel Pumps | 1,002,047 |

| Serpentine Belts | 445,564 |

| Check Engine Light | 1,022,447 |

| Wiper Blades | 291,840 |

| Chassis (DIFM) | 226,012 |

| Car Detailing | 1,364,553 |

| Performance Brakes | 82,034 |

| Perf. Shocks & Struts | 51,300 |

| Tire Replacement | 2,611,495 |

| Battery Replacement | 990,475 |

Niche Trade Audiences

| Heavy Duty Techs | 12,933 |

| Fleet Managers | 20,546 |

| Light Duty Diesel Techs | 96,375 |

| Diagnostic Specialists | 179,569 |

| Techs Researching EPAS | 12,764 |

JANUARY 2020 As we expected, all the numbers for January are up compared to December, except for Fleet Managers. That is entirely due to a significant drop in research on ELD. The mandate’s final date for implementation was 12/16/19, so this makes sense.

Consumer Audiences

| Brakes | 4,063,480 |

| Hubs & Bearings | 469,057 |

| Shocks & Struts | 1,273,581 |

| Fuel Pumps | 1,032,321 |

| Serpentine Belts | 400,713 |

| Check Engine Light | 887,896 |

| Wiper Blades | 296,261 |

| Chassis (DIFM) | 200,801 |

| Car Detailing | 1,614,232 |

Niche Trade Audiences

| Heavy Duty Techs | 13,502 |

| Fleet Managers | 20,546 |

| Light Duty Diesel Techs | 85,681 |

| Diagnostic Specialists | 147,864 |

| Techs Researching EPAS | 12,552 |

| Performance Brakes | 67,874 |

| Perf. Shocks & Struts | 44,685 |

DECEMBER 2019 In 2019 our Audience ID technology found 51,952,048 consumers in market for brake replacement. That represents about 18% of vehicles in operation. 20,386,310, or 7%, of vehicles in operation were found for shocks. Would you like more of them to choose your brand?

Consumer Audiences

| Brakes | 3,251,098 |

| Hubs & Bearings | 406,864 |

| Shocks & Struts | 1,125,037 |

| Fuel Pumps | 783,281 |

| Serpentine Belts | 366,917 |

| Check Engine Light | 761,060 |

| Wiper Blades | 329,833 |

| Chassis (DIFM) | 166,977 |

| Car Detailing | 1,583,088 |

Niche Trade Audiences

| Heavy Duty Techs | 11,906 |

| Fleet Managers | 24,085 |

| Light Duty Diesel Techs | 74,834 |

| Diagnostic Specialists | 127,138 |

| Techs Researching EPAS | 13,947 |

| Performance Brakes | 63,238 |

| Perf. Shocks & Struts | 38,893 |

NOVEMBER 2019 Consistent with data from other automotive focused sites we monitor, we saw a drop in research for most of our focus categories compared to October. A shorter month and the 4 day holiday weekend in November partly accounts for this trend.

Consumer Audiences

| Brakes | 3,634,196 |

| Hubs & Bearings | 500,831 |

| Shocks & Struts | 1,292,844 |

| Fuel Pumps | 846,374 |

| Serpentine Belts | 411,517 |

| Check Engine Light | 943,693 |

| Wiper Blades | 364,652 |

| Chassis (DIFM) | 182,672 |

| Car Detailing | 1,285,999 |

Niche Trade Audiences

| Heavy Duty Techs | 16,792 |

| Fleet Managers | 17,772 |

| Light Duty Diesel Techs | 75,593 |

| Diagnostic Specialists | 149,830 |

| Techs Researching EPAS | 12,989 |

| Performance Brakes | 108,320 |

| Perf. Shocks & Struts | 40,892 |

OCTOBER 2019 All parts and repair audiences are up significantly from September except brakes, but performance brakes audience is way up.

Consumer Audiences

| Brakes | 3,822,683 |

| Hubs & Bearings | 570,715 |

| Shocks & Struts | 1,710,745 |

| Fuel Pumps | 960,722 |

| Serpentine Belts | 468,409 |

| Check Engine Light | 1,157,033 |

| Wiper Blades | 351,886 |

| Chassis (DIFM) | 205,597 |

| Car Detailing | 1,759,824 |

Niche Trade Audiences

| Heavy Duty Techs | 22,367 |

| Fleet Managers | 37,138 |

| Light Duty Diesel Techs | 79,137 |

| Diagnostic Specialists | 164,895 |

| Techs Researching EPAS | 13,326 |

| Performance Brakes | 119,227 |

| Perf. Shocks & Struts | 45,617 |

SEPTEMBER 2019 There was a modest increase in the researching of parts & services. We anticipate a larger increase as the Fall car care season arrives.

Consumer Audiences

| Brakes | 4,727,079 |

| Hubs & Bearings | 501,841 |

| Shocks & Struts | 1,683,411 |

| Fuel Pumps | 894,369 |

| Serpentine Belts | 427,778 |

| Check Engine Light | 983,941 |

| Wiper Blades | 470,775 |

| Chassis (DIFM) | 197,142 |

| Car Detailing | 1,860,196 |

Niche Trade Audiences

| Heavy Duty Techs | 17,053 |

| Fleet Managers | 20,627 |

| Light Duty Diesel Techs | 69,490 |

| Diagnostic Specialists | 151,175 |

| Techs Researching EPAS | 11,720 |

| Performance Brakes | 69,960 |

| Perf. Shocks & Struts | 42,146 |

AUGUST 2019 Largely driven by an increase in managers researching hours-of-service issues and ELD Issues, we saw a significant increase in the fleet manager audience.

Consumer Audiences

| Brakes | 4,164,557 |

| Hubs & Bearings | 550,510 |

| Shocks & Struts | 1,594,549 |

| Fuel Pumps | 912,781 |

| Serpentine Belts | 438,612 |

| Check Engine Light | 1,043,212 |

| Wiper Blades | 347,653 |

| Chassis (DIFM) | 184,859 |

| Car Detailing | 1,758,001 |

Niche Trade Audiences

| Heavy Duty Techs | 19,908 |

| Fleet Managers | 20,175 |

| Light Duty Diesel Techs | 79,885 |

| Diagnostic Specialists | 169,728 |

| Techs Researching EPAS | 11,311 |

| Performance Brakes | 78,403 |

| Perf. Shocks & Struts | 52,501 |

JULY 2019 There was a big jump in the number of consumers researching performance brakes. The shocks & struts category was up, especially researches for performance shocks & struts.

Consumer Audiences

| Brakes | 4,337,963 |

| Hubs & Bearings | 624,816 |

| Shocks & Struts | 1,948,051 |

| Fuel Pumps | 1,010,310 |

| Serpentine Belts | 496,781 |

| Check Engine Light | 1,293,347 |

| Wiper Blades | 291,666 |

| Chassis (DIFM) | 204,952 |

| Car Detailing | 2,138,314 |

Niche Trade Audiences

| Heavy Duty Techs | 22,960 |

| Fleet Managers | 17,958 |

| Light Duty Diesel Techs | 76,608 |

| Diagnostic Specialists | 181,917 |

| Techs Researching EPAS | 9,901 |

| Performance Brakes | 144,819 |

| Perf. Shocks & Struts | 59,875 |

JUNE 2019 As summer approached, we saw an increase in Fleet Managers searching online for maintenance related content. Consumer search numbers remained consistent with increases in Wiper Blade, Detailing Product and Check Engine Light categories.

Consumer Audiences

| Brakes | 4,603,925 |

| Hubs & Bearings | 662,821 |

| Shocks & Struts | 1,767,361 |

| Fuel Pumps | 1,041,762 |

| Serpentine Belts | 507,476 |

| Check Engine Light | 1,280,693 |

| Wiper Blades | 401,375 |

| Chassis (DIFM) | 217,525 |

| Car Detailing | 2,066,307 |

Niche Trade Audiences

| Heavy Duty Techs | 20,460 |

| Fleet Managers | 17,005 |

| Light Duty Diesel Techs | 72,371 |

| Diagnostic Specialists | 191,889 |

| Techs Researching EPAS | 9,395 |

| Performance Brakes | 85,347 |

| Perf. Shocks & Struts | 47,485 |

MAY 2019 Cool wet weather in much of the country seems to have delayed online research for several categories, especially for detailing products. Heavy Duty Techs, Fuel Pump and Belt counts remained strong.

Consumer Audiences

| Brakes | 4,374,803 |

| Hubs & Bearings | 722,953 |

| Shocks & Struts | 1,682,164 |

| Fuel Pumps | 1,084,569 |

| Serpentine Belts | 561,398 |

| Check Engine Light | 1,201,443 |

| Wiper Blades | 330,567 |

| Chassis (DIFM) | 231,070 |

| Car Detailing | 1,920,083 |

Niche Trade Audiences

| Heavy Duty Techs | 27,980 |

| Fleet Managers | 13,397 |

| Light Duty Diesel Techs | 66,957 |

| Diagnostic Specialists | 212,132 |

| Techs Researching EPAS | 10,122 |

APRIL 2019 Diagnostic specialist audience continues to grow. With warm weather near, the audience for detailing products has risen 15%.

Consumer Audiences

| Brakes | 5,165,327 |

| Hubs & Bearings | 722,012 |

| Shocks & Struts | 1,936,656 |

| Fuel Pumps | 1,121,909 |

| Serpentine Belts | 559,746 |

| Check Engine Light | 1,273,141 |

| Wiper Blades | 387,594 |

| Chassis (DIFM) | 232,934 |

| Car Detailing | 2,259,910 |

Niche Trade Audiences

| Heavy Duty Techs | 20,457 |

| Fleet Managers | 30,646 |

| Light Duty Diesel Techs | 75,269 |

| Diagnostic Specialists | 230,764 |

| Techs Researching EPAS | 14,999 |

MARCH 2019 With spring around the corner, more people are researching repair solutions across the board, with an especially high jump in people researching Brakes.

Consumer Audiences

| Brakes | 5,221,831 |

| Hubs & Bearings | 679,342 |

| Shocks & Struts | 2,190,597 |

| Fuel Pumps | 1,143,842 |

| Serpentine Belts | 533,902 |

| Check Engine Light | 1,319,108 |

| Wiper Blades | 418,221 |

| Chassis (DIFM) | 172,781 |

| Car Detailing | 1,995,850 |

Niche Trade Audiences

| Heavy Duty Techs | 21,816 |

| Fleet Managers | 33,226 |

| Light Duty Diesel Techs | 52,698 |

| Diagnostic Specialists | 205,425 |

| Techs Researching EPAS | 16,486 |

FEBRUARY 2019 In spite of being a shorter month, we saw a jump in people researching shocks and struts and hub bearings. The beginning of pothole season may be initiating the increase in these two categories. ELD research for fleet audiences took a significant drop compared to January.

Consumer Audiences

| Brakes | 4,125,200 |

| Hubs & Bearings | 597,492 |

| Shocks & Struts | 1,709,315 |

| Fuel Pumps | 1,090,957 |

| Serpentine Belts | 420,862 |

| Check Engine Light | 1,085,260 |

| Wiper Blades | 487,244 |

| Chassis (DIFM) | 108,194 |

| Car Detailing | 1,581,797 |

Niche Trade Audiences

| Heavy Duty Techs | 23,195 |

| Fleet Managers | 34,437 |

| Light Duty Diesel Techs | 40,515 |

| Diagnostic Specialists | 152,878 |

JANUARY 2019 We saw a big jump in commercial fleet managers researching ELD. We can now break out consumer brakes audiences by sub-categories like Safety, Light Duty Truck, or DIFM.

Consumer Audiences

| Brakes | 4,532,386 |

| Hubs & Bearings | 581,133 |

| Shocks & Struts | 1,664,580 |

| Fuel Pumps | 1,049,309 |

| Serpentine Belts | 453,240 |

| Check Engine Light | 1,121,120 |

| Wiper Blades | 527,380 |

| Chassis (DIFM) | 116,513 |

| Car Detailing | 1,990,645 |

Niche Trade Audiences

| Heavy Duty Techs | 36,120 |

| Fleet Managers | 83,436 |

| Light Duty Diesel Techs | 42,701 |

| Diagnostic Specialists | 168,216 |